Tomo Credit Card; Created with you in mind.

Credit cards are used for so many different purposes that it’s hard to imagine life without them. The importance of having a credit card is vital for your personal finances, as well as your business. It’s part of the reason why the majority of us people have one. With credit cards, you can make the payment for your purchases over time, which makes it easier to manage your budget. It’s also a good idea to have a credit card for emergencies.

But before acquiring one, remember that it’s important to keep your credit score high. Credit score is determined by a number of different factors. However, your credit score will increase if you have a credit card especially if you are following its terms and conditions, and paying your dues on time

tomo

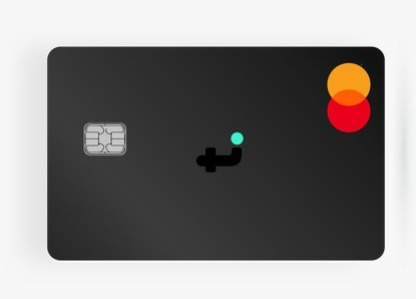

Up to $10,000 Credit Limit No Credit History RequiredSo in this blog, let’s talk about Tomo Credit Card, its benefits, how it can help you, its rates and fees, and what are the things people are saying about it.

What is Tomo?

Tomo Credit Card is perfect for people who have poor or bad credit scores. With this card, you can start your credit score, and then, as you make purchases with it, your credit score will go up. It is a great product for people who want to start building their credit score, but who don’t necessarily have the funds to start with a secured card.

The annual fee is very affordable, just $2.99 per month. Tomo is also perfect for students who wants to start their financial journey. If you are one of those people who have bad credit scores due to inability to make payments on time in the past, Tomo Credit Card got you. This credit card is created by an innovative startup called Tomocredit and is perfect for people with poor or bad credit scores.

Rates And Fees of Tomo Credit Card

Dive into the world of hassle-free finance with the Tomo Credit Card. Say goodbye to overwhelming fees with its low annual charge of just $2.99 per month. Tomo uniquely positions itself as a budget-friendly option in a sea of costly credit cards, making it an ideal choice for cost-conscious consumers.

Tomo stands out by eliminating many common fees. Late payments? Returned payments? Foreign transactions? With Tomo, you won’t worry about any extra charges for these. This approach not only simplifies your financial management but also ensures that unexpected situations don’t lead to unwelcome fees. Plus, with no interest rates to contend with, Tomo keeps your financial journey straightforward and stress-free.

One of Tomo’s most notable features is its accessibility. No minimum credit score requirement means that getting your hands on a Tomo Credit Card is hassle-free, opening doors for a wider range of users. Whether you’re a fee-averse individual or someone just stepping into the world of credit, Tomo offers an uncomplicated and cost-effective solution, proving that great financial tools can indeed come without hidden costs.

Benefits of this credit card

- Affordable rate

- Theft and fraud protection

- Reports to all three major credit bureaus

- Credit limit of up to $10,000

- Credit check is not a requirement

Requirements for Applying for the Tomo Credit Card

To apply for the Tomo Credit Card, applicants must meet the following criteria:

- Age Requirement: Must be at least 18 years old.

- Residency: Must be a legal resident or citizen of the United States.

- Banking Information: A valid U.S. bank account is required.

- Identification: Valid government-issued identification, such as a driver’s license or passport.

- Credit History: While Tomo Credit Card is known for serving those with limited credit history, it’s important to disclose any existing credit history accurately.

- Income Verification: Proof of a stable income may be required, though specific income thresholds are not a primary factor.

Step-by-Step Guide to Applying

- Start by visiting the Tomo Credit Card official website.

- Locate and fill out the application form with personal details like your name, address, and Social Security number.

- Upload a copy of your government-issued ID.

- Enter your U.S. bank account details for financial verification.

- If applicable, provide details about your credit history.

- Carefully review all the information for accuracy and then submit your application.

- After submission, your application will undergo a review process. You will be notified of the decision via email.

FAQs About the Tomo Credit Card

Does applying for the Tomo Credit Card affect my credit score?

No, applying for the Tomo Credit Card involves a soft credit check, which does not impact your credit score.

What is the credit limit for the Tomo Credit Card?

The credit limit varies based on individual financial profiles but is generally competitive.

Can I use the Tomo Credit Card internationally?

Yes, the Tomo Credit Card is accepted globally wherever its network (Visa, Mastercard, etc.) is accepted.

How do I manage my Tomo Credit Card account?

You can manage your account through the online portal or mobile app, which offers features like real-time alerts and balance checks.

U.S. Bank Altitude Reserve Visa Infinite Card Review <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Whether you're off gallivanting across continents or simply exploring your own neck of the woods, the U.S. Bank Altitude Reserve Visa Infinite Card sets you up with all the tools to savor every single moment. </p>

U.S. Bank Altitude Reserve Visa Infinite Card Review <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Whether you're off gallivanting across continents or simply exploring your own neck of the woods, the U.S. Bank Altitude Reserve Visa Infinite Card sets you up with all the tools to savor every single moment. </p>  U.S. Bank Altitude Connect Visa Signature Card Review <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> This top-notch credit card is all about stepping up your game when it comes to traveling and everyday spending. </p>

U.S. Bank Altitude Connect Visa Signature Card Review <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> This top-notch credit card is all about stepping up your game when it comes to traveling and everyday spending. </p>  NHL Discover It Credit Card Review <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Blending the excitement of professional hockey with the advantages of a premier financial tool, this credit card presents unprecedented advantages and privileges. </p>

NHL Discover It Credit Card Review <p style=' font-weight: normal; line-height: 1.9rem !important; font-size: 17px !important;'> Blending the excitement of professional hockey with the advantages of a premier financial tool, this credit card presents unprecedented advantages and privileges. </p>